Investing in Terra

Terra provides extraordinary returns on investment for its policyholders.

As a Risk Retention Group (RRG), each policyholder is required to purchase stock when they first join Terra. For those already accepted into the program, purchasing additional stock has been a fantastic investment opportunity.

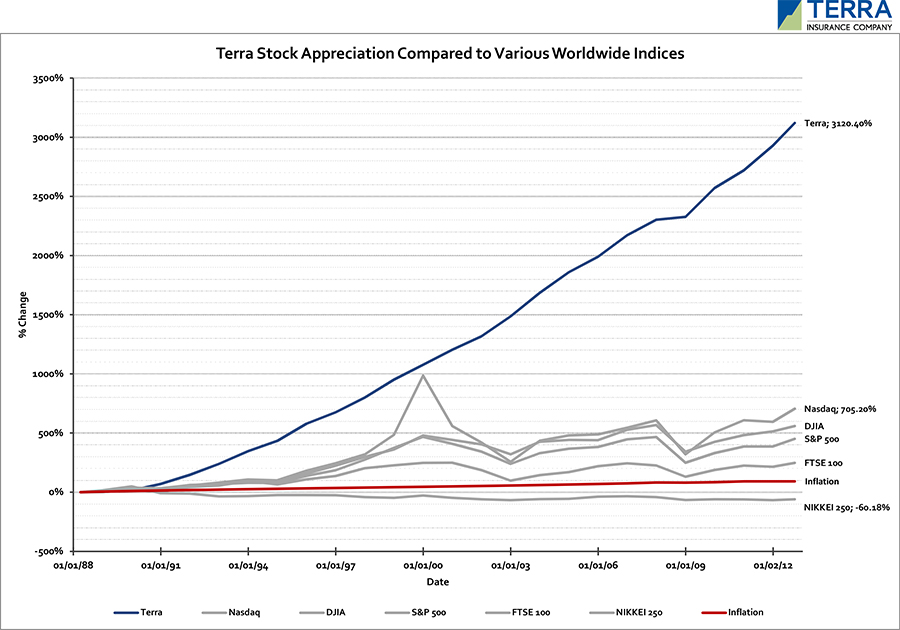

Terra's sharp focus on financial, claim and risk management — along with loss prevention — has generated outstanding results for its policyholders. Since its initial capitalization as an RRG in 1988, Terra’s policyholders have shared in the company's continuous profits through a 3,100% appreciation of their common stock —vastly exceeding the returns of the Dow Jones, NASDAQ and S&P 500 indices as well as the stock performances of most competing insurance companies over the same time period.

Sound underwriting and proactive risk management strategies have enhanced Terra’s excellent financial performance over the years. Because Terra specializes in proactive risk management strategies like Contract Review, Reimbursement of Professional Education Pursuits, and Organizational Peer Review, Terra’s policyholders have extremely low loss ratios by industry standards.

In 1988, Terra policyholders generated roughly one claim per every $2 million in reported revenue. Today, that number has dropped to just one claim per every $26 million in reported revenue. Because Terra is wholly owned by its policyholders, its success translates directly into enhanced investment returns for those same policyholders.

Below, find a graph comparing Terra's historical stock price growth compared to major stock indices.